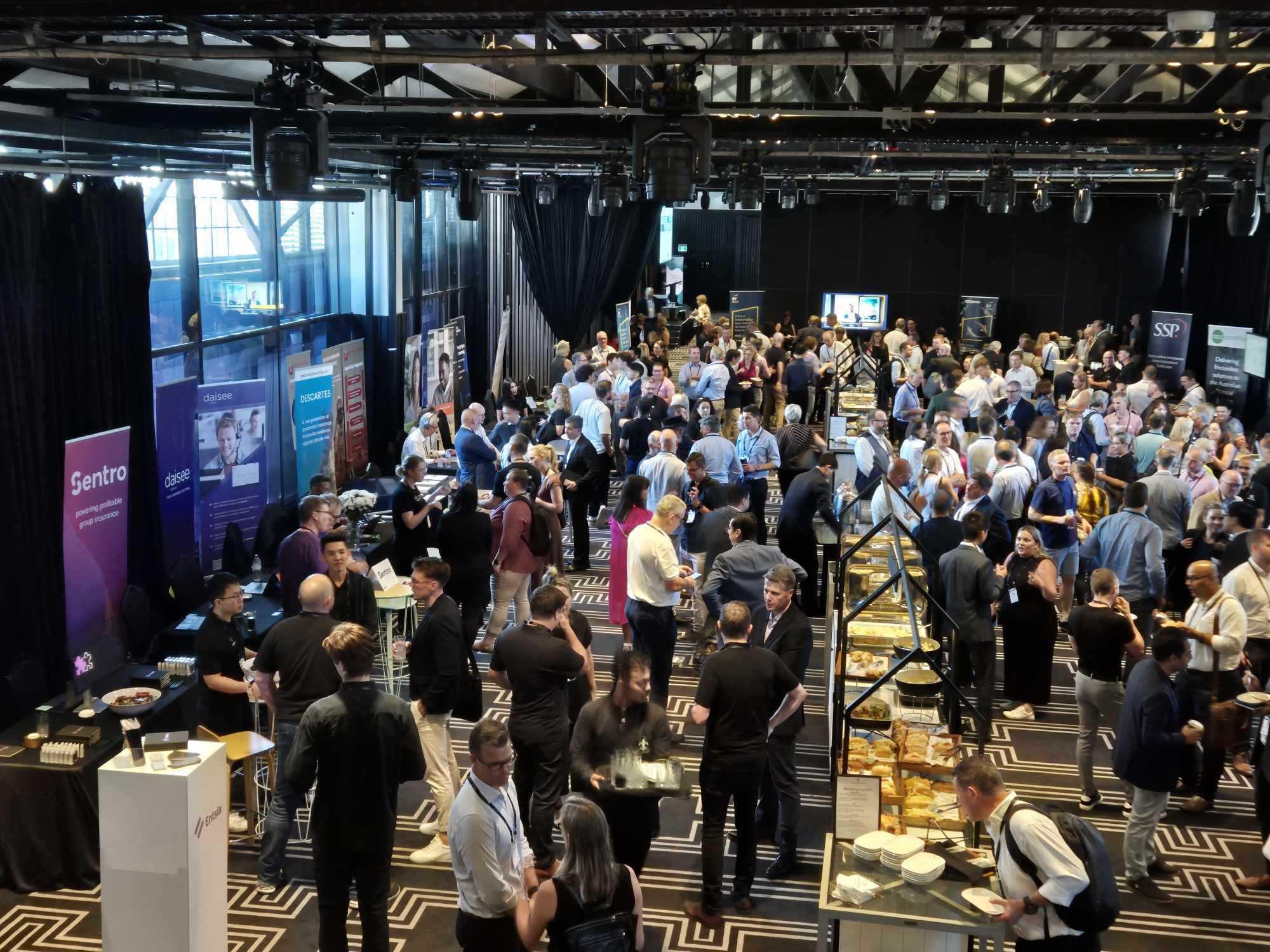

The Sentro team were in Australia last week, exhibiting at InsurtechLIVE24. We met lots of insurers, brokers and tech companies. Here are some of the key things that we took away from our visit.

Less talking about doing something, more actual doing something

We got the sense that the sector has shifted from planning mode into action mode. New ventures are being launched, projects are underway. Cost control still dominates the agenda, but in terms of technology insurers and brokers are realizing that their current legacy technology state is very expensive, so they are open to making change to get better results for less cost.

Total cost of ownership really matters

It doesn't matter how great your technology or solution is if your customer can't make a strong business case for change. They will have a 'status quo' way of doing whatever they are doing now, with known costs. If your proposed 'new way of doing that' isn't in the ballpark of their existing way of doing it (ideally better) from a total cost of ownership point of view, your project is dead before it starts.

Total cost of ownership isn't just the cost of your technology - it is their cost to learn it, incorporate it into their operations, and run it day to day. Migration of current state into 'new state' also shouldn't be underestimated -it may feel small to you technically, but operationally for the customer it can be a huge and risky task. Again, migrations and change projects cost money, and your prospective customer will factor that in to their business cases.

Collaboration and co-opetition can be a winning formula

Exhibiting at InsurtechLIVE24 reminded us how many great solutions there are out there for the insurance industry. Each part of the insurance service lifecycle has its own needs and nuances.

Very few solutions address every single one of these needs. This includes Sentro! So our customers will usually benefit from partnering with multiple providers to get their needs addressed well.

We think that collaborating with other suppliers (even our competitors) can really benefit our end customer. If a customer can see that their vendors are already working together to solve their business problem, it really de-risks their buying decision. It also greatly simplifies implementation and change projects.

We embrace business collaboration at Sentro. We know what we are really good at, and we also know that there are other partners out there that are really good at other things that we don't do. It makes perfect sense to us to work collaboratively with other companies who can help our mutual customers solve their business problems.

Also, a big shout out here to industry groups and support organisations that are trying to foster this kind of collaboration by bringing the supply and demand sides of the sector closer together. Sentro is a member of Insurtech Australia, Insurtech New Zealand, and in Sydney we met with the CEO of Insurtech UK. These industry groups do a great job of promoting what is new in the sector.

It is a good market for Sentro

Our Sentro value proposition really resonated with potential customers and partners in Australia. We continue to hear feedback that our specialization on group insurance administration, with a full feature set yet on a configurable cloud-native platform at a fair commercial price is a compelling combination.

We are optimistic about the Australian market. It builds very naturally on our existing business in New Zealand, Canada and Singapore. We will be spending more time on Australia in the upcoming months.

You May Also Like

These Related Stories

Sentro at SaaStr Annual - why we are still going!

Why brokers are the unsung heroes of group insurance