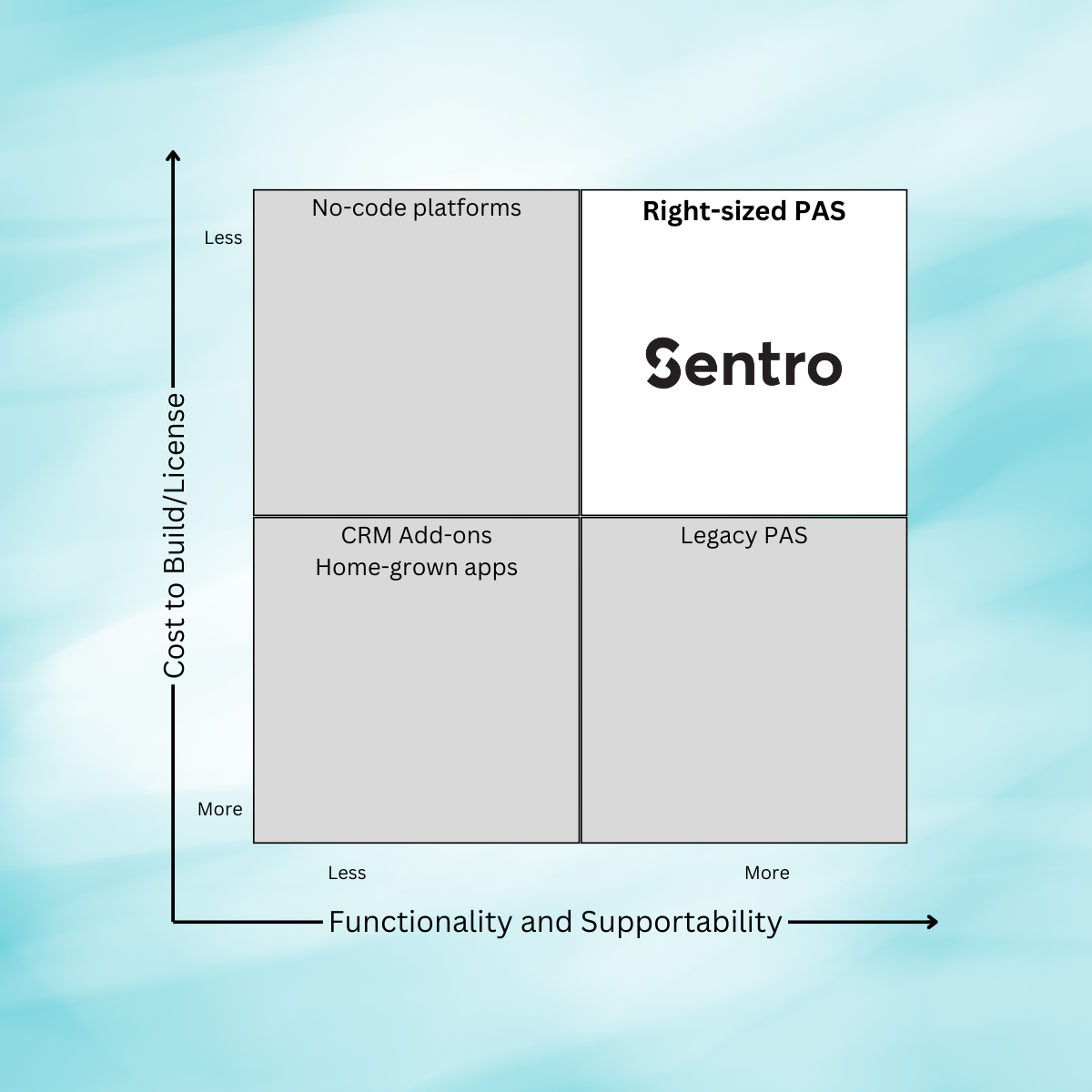

Feedback from around the world is clear. The time is right for a 'right-sized' group insurance policy administration and service delivery platform. Sentro is the right-sized solution for growing group insurers.

The affordability dilemma

Group insurers with a modest but growing book of group insurance business currently face a dilemma.

They're running some group business, probably on spreadsheets or on a legacy platform that wasn't really built for the job of running group. The group business is now starting to grow, but now the operational practices are starting to creak at the seams. Spreadsheets and manual processes don't scale, so growing business means adding administrative staff. The risk team is getting uneasy about information being held and managed all over the place. Customers are expecting online self-service.

Everyone in the business agrees it is time to implement a proper policy administration system (PAS) to allow the group business to be managed holistically and grow efficiently.

So now let's meet Mary. She's the head of Group Sales and Operations of this insurer. Mary is now expected to make a business case for a PAS from the P&L activities of the group business. She has a few million dollars of gross written premium in the group book, decent growth prospects, and can factor in some saved administrative expense by moving from current processes to a group PAS. So she can make the case to spend a couple of hundred thousand a year maximum on a group system. But big up-front implementation costs would be a problem, and it would kill her business case before it starts.

The hopeful search

Let's imagine Mary has convinced her leadership colleagues that it would be worthwhile spending a couple of hundred thousand dollars a year for a proper group PAS application. She gets permission to search for a solution.

With input from her IT team, procurement colleagues, her own industry knowledge and recommendations from former colleagues in other companies, she looks at a number of full-function group PAS solutions run by 'the big players'.

The functionality is impressive. But the systems seem very complex - they feel built for huge multinationals with huge internal IT and administrative teams. And the price tags reflect that - implementation costs alone are prohibitive, never mind the licensing costs of actually operating it. Her IT team aren't really sold on the platforms architecturally either - although cloud versions are offered, these vendors all have on-premises legacy code customers.

The conclusion is quickly reached that although the full-function group PAS solutions run by big insurers are attractive, they are simply unaffordable. Mary reluctantly concludes that she can't make a business case for one of these full-function legacy group PAS solutions based on her existing group business.

The DIY attempt

Mary doesn't give up. She knows that she can't grow her business without an administrative platform. So the next stop is a exploring building something herself using 'low-code' and 'no-code' platforms she's been hearing about.

These solutions are definitely more affordable to license than the full-function legacy group PAS solutions she looked at. But she quickly realizes that the 'out of the box' group insurance-focused processing functionality she needs is limited, or non-existent. Her internal team team or external consultants will have to spend time and money constructing the processing logic she needs to operate her business. Her team doesn't have these skills. Part of the reason for buying a PAS platform was to reduce the amount of effort required from her team to make processes work - not to increase that effort!

So what she might be saving on license costs, she is now spending on construction and implementation costs. And at the end of the exercise, she has now also inherited ongoing logic maintenance and system operations costs.

After a sober assessment, she realizes that a DIY approach is false economy, and that the business case for a low-code/no-code DIY approach doesn't stack up either.

What she needs doesn't seem to exist - a functional, configurable PAS platform built for group business, that is also affordable for smaller books of group business. A group PAS solution 'right-sized' for her business.

Sentro - the right-sized group PAS

We built Sentro to be that 'right-sized' group PAS that Mary (and all the other Mary's in the world) is looking for.

Sentro is the perfect blend of full-function group PAS functionality at a price that growing insurers can make a business case for.

We keep implementation costs reasonable, because everything in Sentro can be configured without writing code. We have rich out-of-the-box group PAS processing functionality - because we designed Sentro with group business in mind. And our shared-success commercial licensing model makes Sentro affordable for customers like Mary.

Your IT architects will love it because Sentro has no legacy code base. Sentro was built cloud-native, with a full API set, and a philosophy of facilitating your access to your own data.

Join insurers from around the world who have discovered that Sentro is the ideal right-sized group PAS!

You May Also Like

These Related Stories

Group insurers - do you have the right tool for the job?

Automation versus personal productivity – getting the balance right