In group insurance, the status quo isn't free

At Sentro, we're often asked "who are your competitors"? My answer is "our biggest competitor is the status quo".

Status quo is a Latin phrase that has survived into common usage in the English language. Literally translated, it means "the state of things" - or the way things are.

In the insurance industry, the status quo is a very popular thing. Keeping things the way they are represents known risk. Changing things represents unknown (or unrealized) risk. In an industry that exists to price and manage risk, knowns costs and risks usually defeat unknown costs and risk.

And yet, the known "status quo" is never risk-free or cost-free. Sometimes, just because existing costs and risks are known, they somehow feel "free" to the entity incurring those costs. They absolutely are not free, and they are generally not fully understood or fully costed.

We are often told "we need to make a business case for implementing your solution". I'd like to turn that on its head a bit. How about "we need to make a business case for the status quo"?

I was reminded of this when I was in Sydney last week. I was a guest of Swiss Re and Insurtech Australia, presenting at a breakfast seminar for some of Australia's leading life insurers.

In my presentation, I outlined where we at Sentro see the current challenges facing most group insurers.

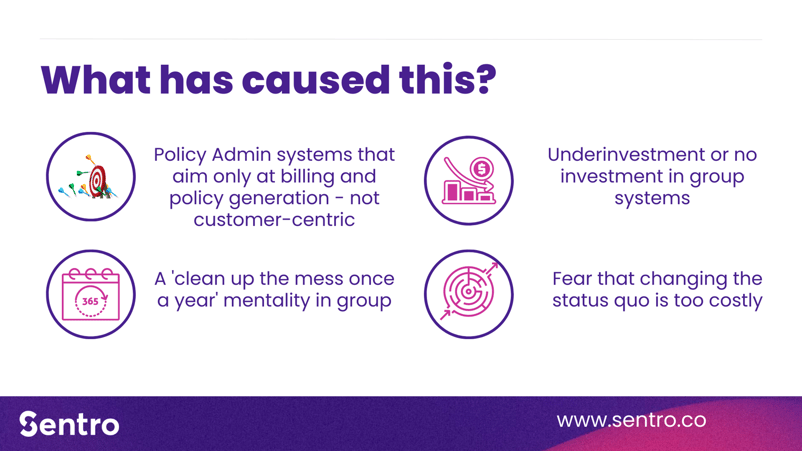

And then what outlined we believe are causing those pain paints.

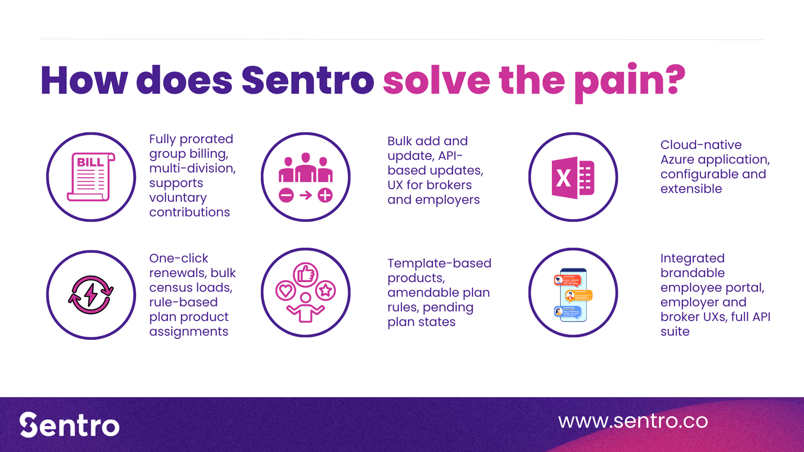

And then, how Sentro addresses these issues for group insurers and group brokers.

The attendees from the life insurers recognized and agreed with our assessments of the challenges in group, and liked our approach to solving them.

One attendee asked me "I agree completely with everything you've said about how group works today. Things need to change. How do your customers go about making a business case to move off the status quo and change to your platform"?

My answer was "When you take a close look at your current operations and truly cost out how much a plan renewal costs, how much a plan installation costs, how much document production and invoicing costs, a business case for change is usually pretty easy to make".

All of that is true. Most group insurers and group brokers take weeks to install and renew plans. The opportunity for efficiency improvement is pretty clear if systems and processes could make that time shorter.

But there are many more costs to the "status quo" than processing time. Some are quite clear and very measurable. Some are softer costs and need deeper understanding to cost out. Others represent costs of lost opportunities and lost business due to the limitations of the status quo. They all count - they represent your cost of operation and your reach of sales and service.

So let's take a look at how you might cost and risk-assess the status quo.

Costing the status quo

When looking at group insurance operations, costs, revenues and risks can generally go into three broad buckets.

- Operational Efficiencies

- Infrastructure, Employee Retention and Regulatory

- Unsatisfied Customer Demand

Let's look at each of these areas.

Operational Efficiencies

This is generally an assessment of how many administrators you need to fully service a book of business. While the focus is usually on the group administration team, don't forget to account for the costs and time of your sales, actuarial, underwriting and finance and administrative teams. What does it cost you to do a quote? How do you send documents to customers and brokers? How much does it cost to adjust the rates or change a product for a customer? How are invoices presented to customers?

When costing operational processes, don't forget about the costs incurred by your distribution partners and customers. Even though these costs won't appear on your P&L, they are very real costs to your customers and partners. They will mentally add those costs to your commissions or premium invoices, and consider them a cost of doing business with you. They are a definite factor in a buying decision.

Infrastructure, Employee Retention and Regulatory

The infrastructural costs of the status quo are generally seen as information technology related costs.

The licensing cost of the policy administration system(s) is only a part of this overall cost. Consider also the internal costs of IT staff, consultants, and IT infrastructure to run it on. Consider also the costs of ancillary systems and processes required to service group business (examples - standalone web front ends, broker portals, external mailing houses, workflow systems, etc).

For internally-developed admin solutions, consider the support and technical risk. Many insurers still run admin systems built on technology that is decades old and no longer supported by vendors. The pool of expertise of developers and analysts still working on these older technology platforms is also diminishing with time, adding to cost and increasing risk. As the base systems running these applications run out of support, the operational and security risks can become unacceptable. If your base operating system and application layer are no longer being updated, how can you say that your systems are secure from today's technical risks?

More hidden, but absolutely real, are costs relating to admin employee retention and attraction. The group administration team are the unsung heroes of group insurance. They are the ones that have to invent work-arounds to the limitations of administrative systems and processes. They have to invent new processes when the sales team sells something that the operational systems can't easily support. Group administrators have an enormous amount of tacit knowledge, and somehow keep things working with their ingenuity. They have usually been promised system improvements for years, but the business never actually makes that investment. The pressure on these teams increases, as customers increasing want and expect real-time service. Eventually, administrators tire of being the human glue that compensates for poor systems and processes, and leave. Replacing administrators is really difficult. Learning a system is easy enough, but replacing the tacit knowledge about workarounds and exceptions is incredibly difficult.

Retention of sales and partnering staff is also a very real risk. If you cannot offer competitive products and services into the marketplace due to the limitations of your systems and processes, your sales teams will either be unable to bid business, or will lose business to competitors who have a better proposition. Eventually, your sales teams will move to competitors who have a better product and service proposition.

Regulatory drivers are very real risks. Are your admin systems and processes capable of producing the level of information detail required by the IFRS-17 reporting standards? Are your information management practices capable of supporting privacy and data sovereignty legislation? Are you really comfortable emailing files around containing sensitive information like employee salary details? Risks in these areas are very real.

Unsatisfied Customer Demand

A trend we have noticed worldwide in group insurance quotation requests is an increasing requirement to provide an online employee and employer portal to service the group plan once active. The inability to provide this online service immediately rules out many insurers from contesting for these plans. This is not only lost business for them, but it also further distances the insurer from the end customer, and increases the role and dependency on the broker who will often provide these services themselves (at a cost).

The inability to offer plans with options, plans with voluntary contributions, plans with slightly different benefits, or grandfather in plans with complex benefit rules will also often exclude insurers from contesting for business. Insurers more able to support more nuanced plans and products will be more successful with customers who are looking for these things.

Customers also have preferences in information presentation and information management. Can you format my invoice in a certain way? Can you co-brand insurance certificates and employee portals? Can you process the information I extract from my HR system as-is? Providers more able to accommodate customer preferences will be more successful.

All of these aspects affect customer churn rates, and new business generation. They are a factor in the 'costs of status quo'.

Tools that can help

Making a business case for the status quo can be an eye-opening exercise. If you'd like some help in doing this, at Sentro we've built some great calculators and analysis tools to help you assess your current costs and risks. Contact us and we can help you show that the status quo may not be the bargain that your bosses think it is.

You May Also Like

These Related Stories

Sentro earns Microsoft IP Co-Sell status

Want a way out of insurance legacy system jail? Make sure you ask the right questions!