Sentro's Third Party Administrator service solves problems for insurers and brokers

Early in 2023, we announced the availability of Sentro Third Party Administrator (TPA) services. Initially available in New Zealand, we are now receiving more and more enquiries from insurers, brokers and MGAs about the offering.

What is a Third Party Administrator?

Definitions vary, but broadly a Third Party Administrator provides processing services to insurance companies and insurance brokers.

Sentro TPA Services are focused purely on the sales and policy servicing aspects of insurance operations. We do not provide claims-related services at this time.

Services we provide include (but are not restricted to):

- Quotations

- Product, Benefit and Pricing Setup

- Group Plan Setup

- Customer Onboarding

- Customer Service firstline enquiries

- Policy Issuance

- Billing Services

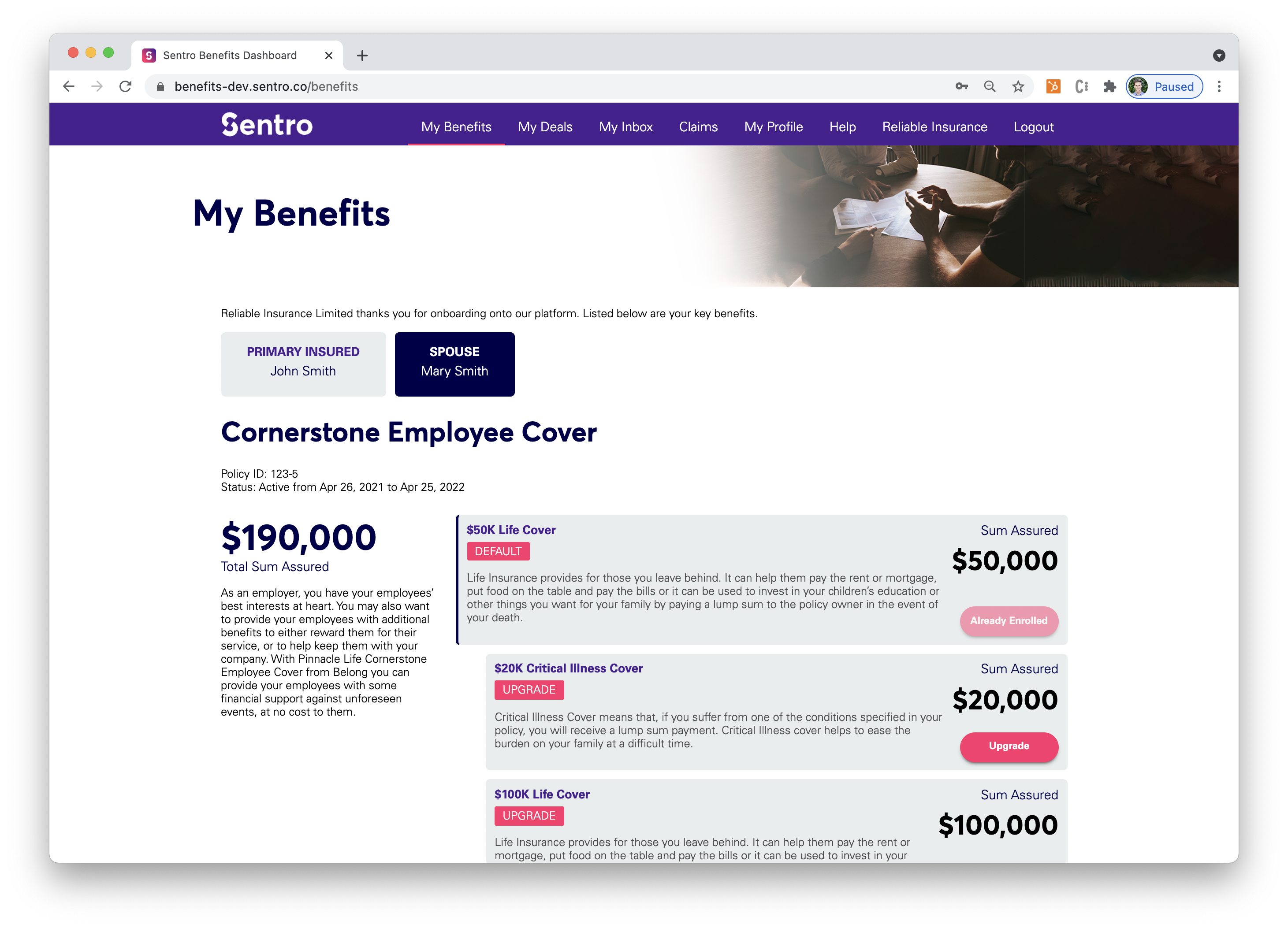

- Self-service Employee Portals

- Data migration Services

- Reporting and Analytics Services

- Distribution and Referral Support

Who we are working with

We are currently providing Sentro TPA services to Pinnacle Life, Tower Insurance and nib in New Zealand. We are getting enquiries from other insurers in New Zealand, as well as from other countries.

That tells us that there is genuine market appetite for a TPA partner who can provide modern, flexible administration software, backed up by experienced people who provide great service.

What we are learning

Since launching our Sentro TPA offering, we have discovered that almost everyone has a 'difficult' product line or unique customer situation that needs to be handled in quite a different way than their 'mainstream' product sets.

Using a TPA service for situations like this can really solve problems for insurers and brokers. Rather than trying to handle the exceptional processing often required by these 'outlier' situations, they can instead partner with a TPA to administer just this part of their business. They can then focus all of their internal efforts on making their mainstream offering attractive and efficient, without having to worry about handling the 'oddball' processing required by these outlier schemes. They can just hand that particular challenge off to their TPA partner.

Our secret sauce in the TPA market

What gives Sentro unique advantages in the TPA market? It is of course the Sentro platform itself!

Our state of the art, cloud-native, API-centric admin platform lets us easily handle a wide range of product, policy and and billing scenarios. We have the tools to handle employee adds and updates in bulk, and can assign products based on data parameters. Our configurable platform lets us respond very quickly to a new customer service request. Our competitors in the TPA space do not have this advantage - so they often cannot handle certain types of processing, or they handle processing manually, adding risk of error and data leakage.

Of course, providing great service is not done by software alone. Our Sentro team have years of experience working with insurers and brokers. Our people are committed to the success of the insurers, brokers and MGAs we work with, and ensure that their customers receive excellent, accurate, responsive and friendly service.

Interested in learning more? Please contact us for a chat! We love helping insurers and brokers solve their problems.

You May Also Like

These Related Stories

Sentro announce Singapore customer

Unlocking the Power of Sentro's CRM Features