New FMA CoFi guidance adds a new role for NZ employers

The Financial Markets Authority (FMA) is a regulator of the New Zealand financial services sector.

Market participants in the insurance sector have been eagerly awaiting direction from the FMA on how it will interpret the Financial Markets (Conduct of Institutions) Amendment Act 2022, shorthanded in the industry as CoFI. CoFI amends the Financial Markets Conduct Act 2013 (FMC Act) to introduce a new conduct regime aimed at ensuring financial institutions treat consumers fairly.

The FMA has released a "guidance note for intermediated distribution", which is intended to guide the industry in how the FMA intends to monitor and enforce the new CoFI legislation.

Of particular interest to us at Sentro is how the FMA considers CoFI/consumer fairness in the context of group insurance. There were a couple of quite noteworthy items in the guidance.

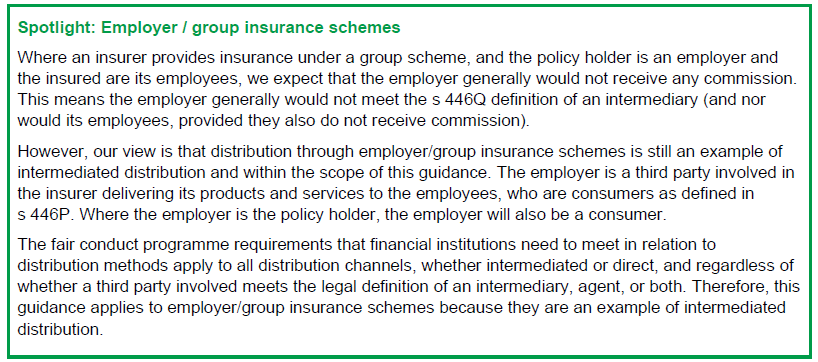

Group insurance is clearly within the scope of the CoFI regime

This Spotlight section makes it quite clear that the FMA considers group insurance schemes part of the CoFI regime.

The guidance also notes one of the things that makes group insurance unique. The employer is not only an "intermediary" (with responsibilities to provide information to employees) but also is a "consumer" (the holder of the group policy).

It would seem that this guidance would apply whether the employer buys the group policy directly from the insurer, or via a broker.

The FMA considers the employer an intermediary in group insurance schemes for the purpose of CoFI

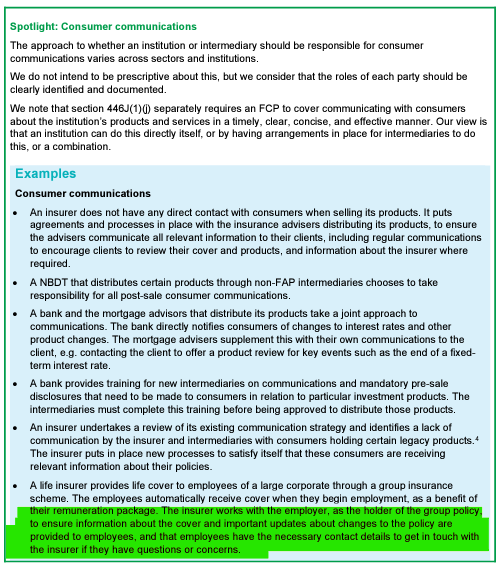

The FMA sees group insurance schemes sold and serviced by intermediaries as covered by CoFI. While the expectations of insurers and brokers in group insurance was always expected, the employer who buys the group scheme also has an intermediary role to play as far as the FMA is concerned. Here's an excerpt from their guidance.

This example makes the employer an "intermediary" - with a role to play in collaboration with the insurer to communicate information to employees about their coverage and contact points.

What are the implications for group insurers, brokers and employers?

There is an expectation that when insurers create group insurance products, that part of the product design will include how information is communicated to employees covered by the group plan.

The FMA also expects product design to clarify how group insurers, brokers and employers will collaborate to ensure those covered by group policies (employees) receive proper information and service.

The FMA guidance places a more explicit focus on the role of the employer to communicate information to their people about their group insurance benefits and contact points.

Insurers, brokers and TPAs who can offer employers ways to easily comply with their "new role" as an intermediary will have a market advantage. For example, let's imagine three different ways that the employer might receive group insurance information from the insurer.

- Printed employee policy documents that need to be hand-distributed to employees

- Electronic PDF employee policy documents that need to be e-mailed to employes

- Online employee portal where employee can see their policy information and insurer contact details

Each method places a different burden on the employer. Our belief is that providers who can best support employers with their compliance efforts will have an advantage both in the market, and also in the eyes of compliance regulators.

How Sentro helps group insurers engage with CoFI

The Sentro platform offers group insurers, brokers and employers built-in capabilities to help meet the goals of providing timely information to employees in group schemes.

- Employee Portal - Sentro lets insurers and brokers offer an online employee portal that allows employees to securely access their benefits information and see their insurer contact points

- Employer User Experience - Sentro's Employer UX lets the employer administer the membership of their group and facilitates service from the insurer and broker

- Designed for Group, Designed for Collaboration - Sentro allows insurers, brokers, benefit providers and employers to collaborate on a "single source of truth" group insurance platform. This facilitates the style of collaboration being sought in CoFI.

The new guidance emphasizes our core driver at Sentro - to make things easier and better for everyone in the group insurance service team, so that the employee gets the best possible products and service.

If you would like to learn more about how Sentro can help, please contact us!

You May Also Like

These Related Stories

Sentro launch Third Party Administrator Services in New Zealand

Group insurance is booming in New Zealand