Group insurers - do you have the right tool for the job?

My dad was a carpenter. While I didn’t inherit his carpentry skills (which I was reminded of when I’ve been doing some home maintenance lately), some things that he taught me have stayed with me throughout my life.

"You need the right tools for the job you are trying to do". "Having the right tools makes a difficult job easier".

"You want to measure something twice and cut it once".

I was reminded of Dad’s wisdom a few times this week. I am reminded of him constantly as I replace decking timber. But I also thought about him when I presented Sentro alongside other terrific New Zealand insurtech companies at an Insurtech New Zealand showcase event. Many thanks to Tower Insurance CEO Blair Turnbull for hosting and MCing the event! Sentro is proud to be a Tower Insurance partner.

Sentro is a policy administration and customer engagement platform designed very much around the needs of group insurers and group benefit providers and their customers. Our friends at JAVLN zero in on the needs of the broker segment. InsuredHQ target fire and general and microinsurers. Quashed helps the individual manage all of their insurances.

Both Sentro and InsuredHQ have been recognized as finalists as ANZIIF Insurtech Startup Of The Year, which is really cool for both of us.

,

All of us are building the right tools for quite different jobs.

When we started Sentro, one of the things I said at the outset was “group is different”. Group insurance and group benefits administration is unlike any other kind of insurance – because you have two customers for the same product. One customer is the employer. The employer makes the decision around buying it. The other customer is the employee. They receive the product, sometimes contribute to the cost of it, and ultimately decide if they think it is useful or not.

The needs of the “two customers” of the group product are very very different. The employer wants value for money, little or no administrative pain to run the scheme, tidy invoicing and payment routines, applause from their employees for giving them such a good thing, and a responsive and highly empathetic employee experience at claims time. The employee wants simple, clear language about what they are receiving, and a consumer-level service experience when they want to adjust their plan or make a claim.

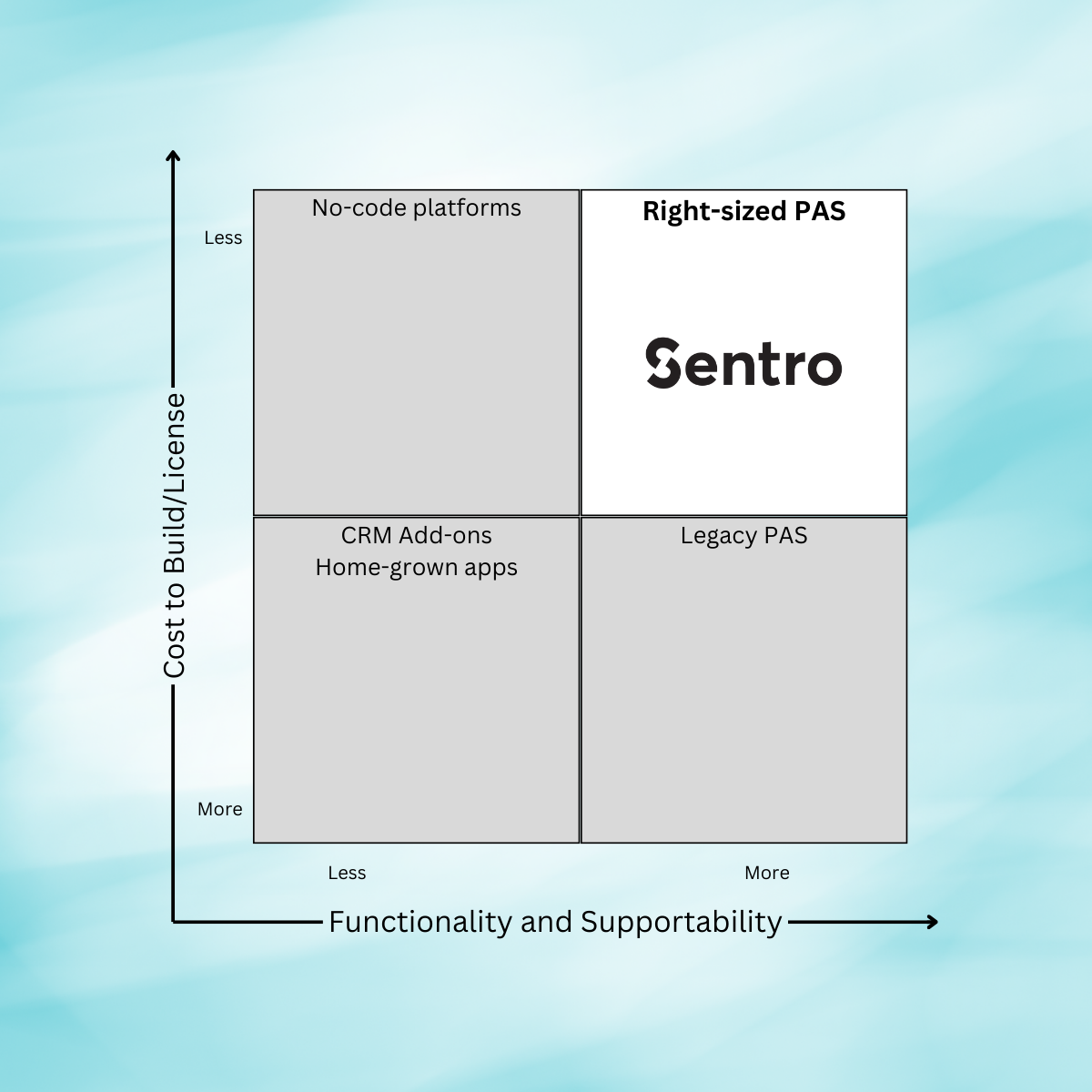

If your policy administration system isn’t designed to serve these two customer needs with elegance, you simply have the wrong tool for the job.

Most policy administration systems out there simply do not serve the highly specialized needs of group insurance and group benefits well. Maybe the billing engine can’t handle complex group plan billing. Maybe group enrolment is lacking. Maybe voluntary top-ups to group plans aren’t handled well.

To go back to the carpentry analogy “if all you have is a hammer, everything starts to look like a nail”. Most PAS systems are designed for property and casualty, and retail life and health scenarios. They are good at what they do! They are good tools for that job. But those tools are generally designed to serve one customer (the retail policy buyer), not two (the group policy buyer and the employee receiving the policy benefit). When you try to use that one-customer tool for group insurance and group benefits management, it just doesn’t do the job well.

Sentro is the right administration tool for the group insurer and group benefit provider. It is a specialized tool, built for a complex and specialized job.

While I didn’t inherit my dad’s natural skills in carpentry, making Sentro the best tool on the market for group insurers and group benefit providers is a lot of fun!

You May Also Like

These Related Stories

Data-driven product assignment delivers group insurance customization

Sentro releases new Connect module