Data-driven product assignment gives group insurers powerful new customization capabilities says Sentro's Hans Frauenlob.

"At Sentro, we believe that it should be easy for employers to look after their people. We also believe that offering employees choice and flexibility in their group insurance and benefit plans should be a normal thing, not an exception. So we asked ourselves - how could we make it really powerful and simple for insurers and brokers to offer group plans that could assign the right products to the right people?"

"Group insurers want to offer more choice and flexibility in their group plans" says Hans. "But one of the things that holds them back is - how do you offer every employee something different without also incurring massive administrative back office overhead?"

"The answer is data-driven product assignment. Group insurers have been offering multi-category plans for years. The executive team might get a different set of products and coverages than the staff team.

We take that basic idea - offering different plans to different employee categories - to the next level. What if you could assign products not only based on an employee category, but on any data attribute you might hold about an employee in the group?"

Data-driven product assignment delivers exactly that. Imagine an insurer offering a wellness service alongside their insurance products. The service is designed for women, and is currently only available in the city of Toronto. The insurer also wants to further target the service to their Employee Category A plans.

Using data-driven product assignment, this wellness service can be added to all group plans, but assigned only to women in Toronto, who are also in employee category A.

How it works

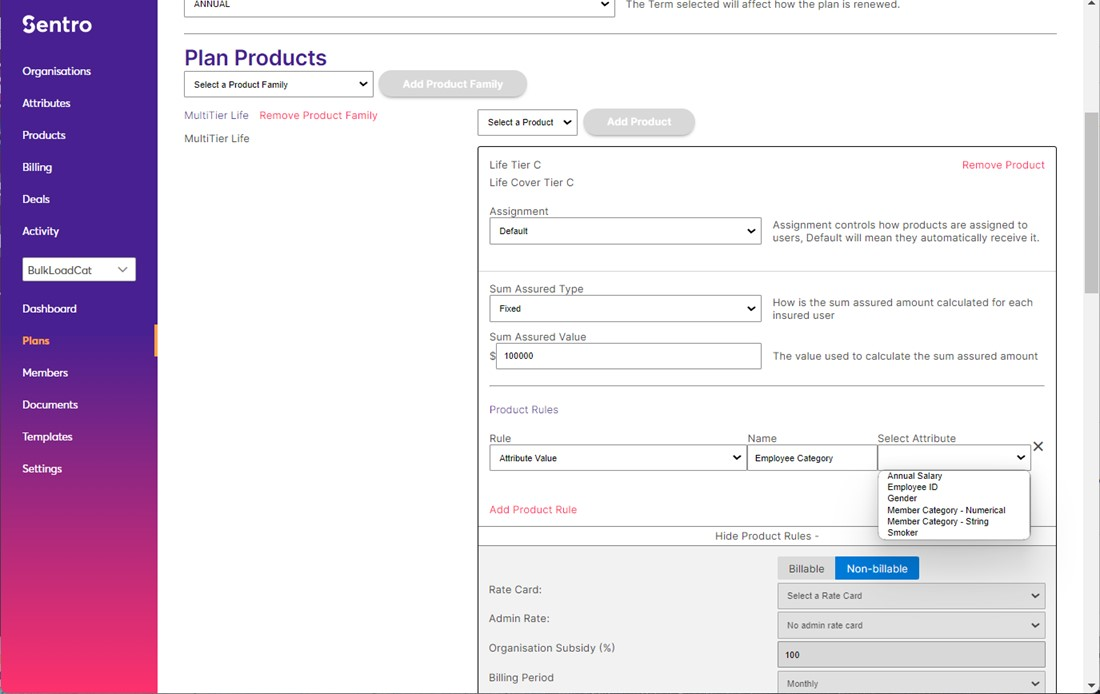

Sentro's Attribute Value Product Rule lets plan administrators assign products based on any data value in the member record.

The administrator can specify both the attribute to use, and the value to be compared.

When the group plan is assigned to the employer, these values are tested. The product is only assigned to members who meet the specified rule conditions.

Data-driven product assignment is available now on Sentro.

"Data-driven product assignment is yet another example of our commitment to make Sentro the best group insurance and group benefits administration solution on the market" says Frauenlob. "We already give group insurers, brokers and TPAs a competitive edge. Our aim to turn that competitive edge into a wide gulf".