Changing Group Plan coverage amounts is now easier than ever

Quality of life just got a lot better for Group Plan administrators who need to make Group Plan coverage adjustments with the general release of Sentro's Bulk Underwriting capability.

Sentro, the leading Group Policy Administration System for mid-market insurers and brokers, made the announcement for Insuretech Connect in Las Vegas.

"Bulk Underwriting is a gamechanger for operations teams at group insurers and brokers" said Sentro CEO Rob Ellis. "There are lots of situations when someone's coverage level needs to be changed. Most of the time, this means one-by-one changes to each member in the Plan. That can take hours for a large plan when you need to make a lot of coverage adjustments. With our Bulk Underwriting capability, these changes can be processed in a single step, in seconds".

What is Bulk Underwriting in Sentro?

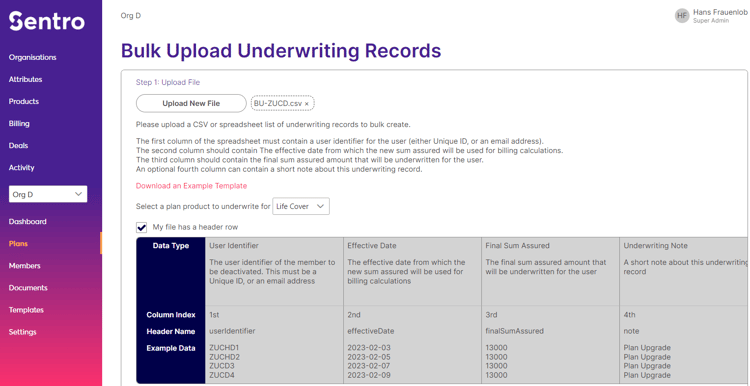

Bulk Underwriting lets a Plan Administrator adjust the Sum Assured coverage amount on multiple insured member's Plans in a single transaction. A simple file can be uploaded to Sentro with the required adjustment information.

The date for the change in the coverage amount to take effect can be specified, and can be different for different Members in the uploaded list.

An Underwriting Note can be supplied with the uploaded file. The Note stays with the Member's Plan Product and forms part of their Underwriting history.

The uploaded file is error-checked before processing.

When the Bulk Underwriting transactions are processed, the coverage amounts are adjusted at the requested dates on the Member's Plan Products.

When would you use this feature?

Claim Events

This feature is ideal for processing coverage limit adjustments created on claim events. For large schemes, there can be dozens of coverage adjustments to process every month. Now, when you get your adjustment list from the claims department, you can apply the coverage changes in seconds.

Mid-term Upgrades or Downgrades

Another use case is coverage upgrades or downgrades mid-plan. Sentro's Underwriting feature makes the coverage limit change effective on a specific date, which can sit inside a Plan Period.

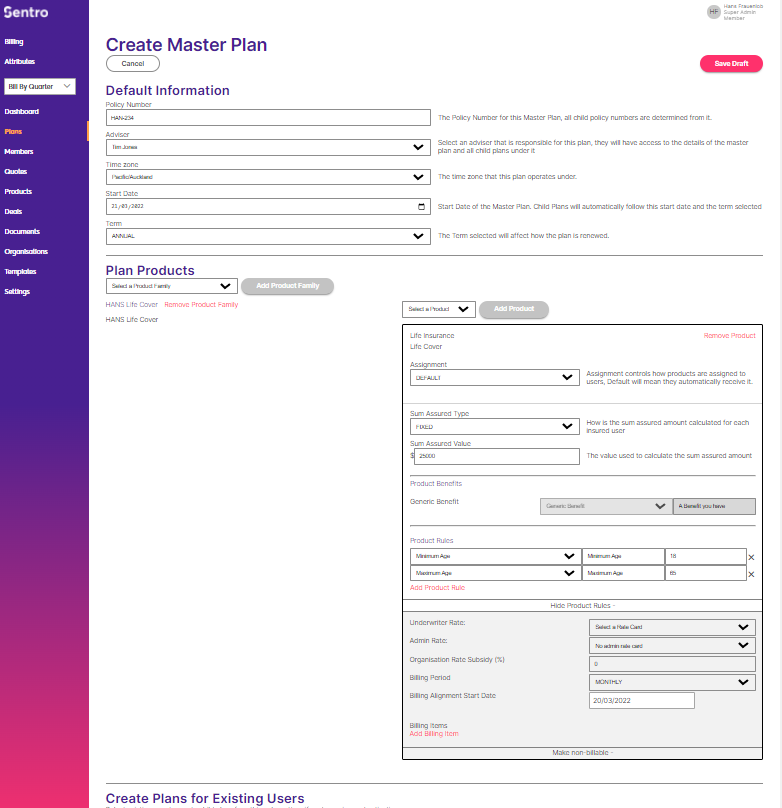

Let's say that a customer is on an Annual plan running Jan 1 to Dec 31, and everyone on the plan is covered with a $25,000 Life cover product. The employer decides that at July 15, she'd like to up the coverage to $50,000 for everyone in the team.

With Bulk Underwrite, the new Sum Assured coverage amounts can be set to take effect on July 15. Sentro automatically pro-rates the July premium charges - from July 1-14 the Member is charged at the $25K coverage level, and from July 15-31 they are charged at the 50K coverage level.

With many PAS applications, you would need to close out the existing plan and re-issue a new one at the July 15 date to give the new coverage limits effect. With Sentro Bulk Underwriting, the changes can be applied mid-term, and the adjusted amounts are preserved at plan renewal time.

Member-selectable coverage amounts

Many insurers and employers want group schemes that let their employees choose their coverage amount. For example, an employee might be able to choose Life Insurance coverage in $10,000 increments, with a minimum of $50,000 and a maximum of $150,000.

In this situation, Bulk Underwriting is ideal. It allows the Plan Administrator to specify different selected coverage amounts for different employees for the same base product, and process all selections as a single bulk transaction.

Billing the coverage changes accurately

Because Underwriting transactions in Sentro adjust coverage amounts at a specified date, Sentro's powerful Billing engine automatically calculates and pro-rates the correct premium amounts for the adjusted coverage.

Coverage amounts can be adjusted multiple times over the course of the Plan period, and Sentro will handle the pro-ration and calculation of the correct premium charges due for each different period of coverage. Underwriting History allows the Plan Administrator to see when changes in coverage took place, and the reasons why.

This means it is no longer necessary to make an end of year billing adjustment when coverages are adjusted during a Plan period. Sentro takes care of getting the premium calculations right - even when the changes are processed retroactively.

Available now

Bulk Underwriting capability is available now to existing and new Sentro customers. Contact us to learn more or see a demo.

You May Also Like

These Related Stories

New Sentro Plan capabilities - a gamechanger for group administrators

Sentro earns Microsoft IP Co-Sell status

.png)